By Tatjana Kulkarni

Digital Lenders are taking over. The year 2017 has been the year for bitcoin, but it has also been the time for digital lenders, who seem to be experiencing significant growth across personal, SME, and student-focused verticals.

Despite the abysmal stock fall of LendingClub, arguably the pioneer in the online lending space, digital lenders in 2017 has seen steady growth in the space and will continue to do so in the coming years.

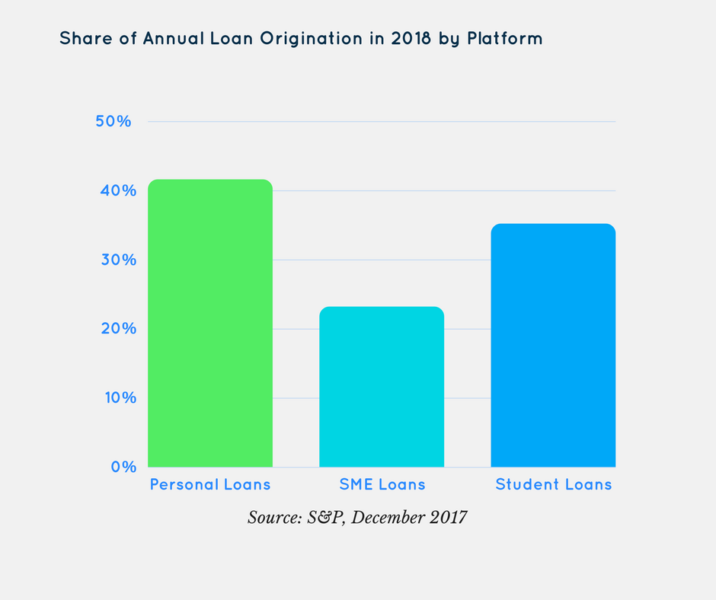

As noted in a recent S&P Global Market Intelligence report, personal, small and medium enterprise, and student-focused segments will originate $62.84 billion in new loans in 2021, representing a compound annual growth rate of 16.5% during the five-year period ending December 31, 2021.

According to the report, personal-focused lenders will remain the main source of originations. SME and student-focused lenders are likely to a big spike in the coming years, the report predicts.

Fintechs are likely to get more involved in the lending space too, according to a separate Transunion report. In that report, fintechs represented 32% of personal loan balances compared to 29% by banks and 24% by credit unions, in the first half of this year alone. (More on this here).

Read full report here.