India has been faster than the US, UK and China in adopting mobile wallets, according to a survey done by data and analytics company GlobalData. The report says 55.4 percent of survey respondents from India said they have a mobile wallet and use it.

This was significantly higher than data from the US and UK, where only 14.7 percent and 8.1 percent respondents said they have and use mobile wallets.

China and Denmark followed India, with 54.3 percent and 49.3 percent respectively.

“While medium to large-value transactions continue to be made through digital banking channels, the low-value day-to-day transactions are carried out through mobile wallets.”, GlobalData said.

Ravi Sharma, senior analyst at GlobalData’s Payments practice, said “The growth in mobile wallet market is fueled by the government’s policies to promote electronic payments, coupled with rise in smartphone penetration, and improved telecom and payment infrastructure.”

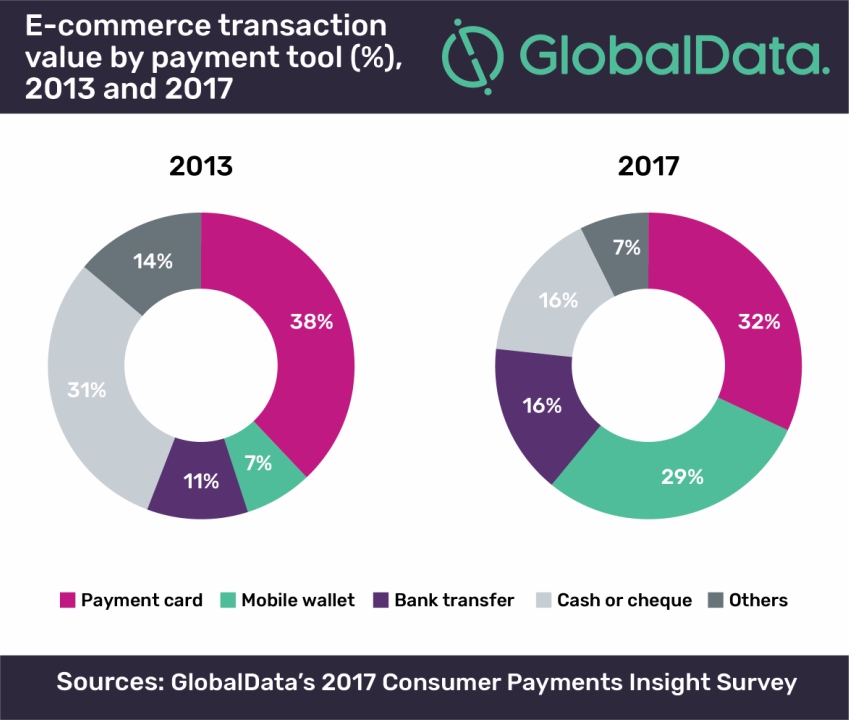

Payments leads the mobile wallets market in India, accounting for 9.9 percent of the share in the value of e-commerce transactions.