The unsecured lending market in Australia has grown significantly in recent years. A report conducted by the Australian Centre for Financial Studies examined the impact of unsecured small business and personal loans on the economy, and particularly how this sector impacts the broader economy. Thanks to disruptive technology a.k.a. FinTech enterprise, the online lending market, particularly for small business financing has grown significantly in recent years. Nonconventional marketplace lending services have cut into bank lending to SMEs over the years. By streamlining borrowing processes, market players now have access to financing via an alternate pathway. Unsecured lending takes on many different forms, notably peer-to-peer lending, small business lending companies and the like.

Now, lenders and borrowers can come together to enjoy the benefits of personal and business loans for growth and development. The pricing methodology in effect is largely risk-based. This means that borrowers with better credit histories and credit reports qualify for better interest rates on their loans. The Australian small business lending model is such that increasing transparency is the order of the day. Much of the impetus for the Australia unsecured lending market is derived from abroad. For example, unsecured lending in the US is a sizeable marketplace, and by far the greatest in terms of loan volumes anywhere in the world. Unsecured business loans have gained in popularity in Australia, particularly since the established banking and financial sectors have placed strict regulations in effect.

The Reserve Bank of Australia (RBA) estimates that 60% + of all lending takes the form of mortgage loans. With their focus clearly on this form of lending, there is a large gap in the market with respect to unsecured loans. Since the banking industry has opted for a risk averse approach to its financial activities, many non-bank entities are stepping up to fill the void. The unprecedented growth of e-commerce activity in Australia has placed the land down under firmly in the top 10 e-commerce markets (studies conducted by AT Kearney). Owing to the robust telecom infrastructure, developed logistical and financial systems, Australia is a top-ranked country for e-commerce. Internet usage and online penetration is exceptionally high in Australia, making it possible for small businesses to access unsecured lending from non-bank entities. Given the regulatory environment in Australia, compliance is still mandatory with marketplace lenders. This means that while the same level of scrutiny will not be applied to non-bank lending, there is a degree of caution among lenders vis-a-vis disruptive technology and the provision of lending services.

Australian Banks Cutting Loans to Lowest Levels in 7 Years

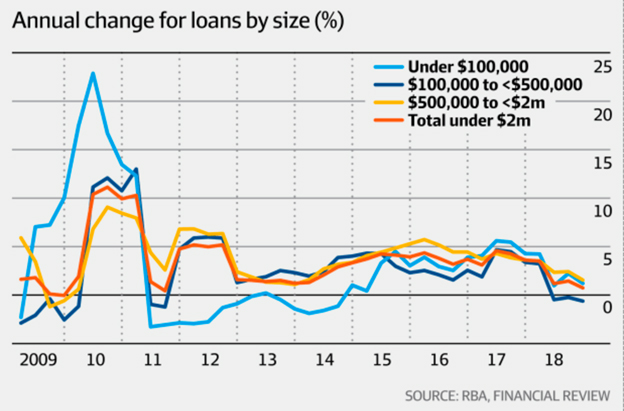

Like many other developed economies, Australia is moving away from a cash-based system to a non-cash payment system. In fact, non-cash options account for approximately 50% + of payments transfers in Australia. In 2014, non-cash payments comprise AU$227 billion, or 14% of GDP. Since then that number has swelled significantly. An article linked by the Financial Review in April 2019 (Matthew Cranston Economics Correspondent) indicates that small business lending in Australia has fallen. The RBA insists that lending to SMEs is on the rise, but SMEs claim this is not so. For the past three quarters (before April 2019), evidence suggests that the growth in bank loans between AU$100 K and AU$500 K has been negative, and is approaching the lowest annual growth rate in 7 years. Loan amounts were highest pre-financial crisis and dropped precipitously in the aftermath.

The credit squeeze is real in Australia

Council of Small Business of Australia

CEO Peter Strong

Part of the reason why businesses are finding it difficult to use their property as collateral for loans in Australia is falling house prices. Allied with lending restrictions, banks are restricting growth in this industry. Australians are well familiar with bank rejections of small business requests. Clients are finding it increasingly difficult to borrow funds from banks and established financial institutions, paving the way for the growth of alternative lending industries. Business owners who struggle to finance daily operations, are at the mercy of tightening regulations. As such, SMEs who sell up cannot find buyers since there is limited financing available for these activities.

Loans in the amount of AU$2 million or less have slowed to approximately 0.8% (the lowest rate in over 7 years). Loans in the amount of AU$500,000 – AU$2 million also slowed substantially. The Australian government is increasingly concerned about the lack of financing available to SMEs. As such, the ABSF (Australian Business Securitisation Fund) was established to encourage lending to SMEs by bank lenders and non-bank lenders. To paraphrase David Gandolfo of Quantum Business Finance, ‘Banks have deployed a self-imposed consumer credit-style guidance on lending to SMEs which the Hayne Royal Commission said should not be applied.’

The advent of non-bank lending companies has helped alleviate much of the quagmire. Now, it is possible for Australian small and medium enterprises to qualify for business loans in as little as 24-hours. This is a substantial step up from the weeks or months of waiting that typically accompanies bank loans to SMEs. Of course, increased lending options does not necessarily bode well for economic prosperity. If businesses are finding it difficult to acquire financing and turn a profit, then unsecured business loans risk the creation of another credit bubble.

That’s the very thing that banks and regulators are diligently trying to avoid. Stimulating economic activity through increased lending to SMEs should be conducted in a systematic manner. Checks and balances must be maintained to ensure that financing is being channelled in the right direction, and not in a haphazard manner. Small businesses will also be mindful of the higher costs (high APR and interest rates) associated with non-bank loans. The trade-off is often worth the risk since businesses cannot function without cash flow and that’s precisely what non-bank lending facilities provide.